Increasing Demand for Greater Network Speeds Means Clear Favorites in Ethernet Switch

If there's one thing that's proven universal about network usage, it's that users want more speed. This isn't out of line, really; given the sheer number of things that the network is used for—from work to play and beyond—wanting these things to move more quickly so more of it can get done in the same amount of time makes sense. That same growth, according to an IHS Infonetics report, means some clear winners in the Ethernet switch field as well.

The IHS Infonetics report in question—titled IHS Infonetics Ethernet Switches—shows that the market for Ethernet switches in general is on the rise, with worldwide revenue up 9 percent in the second quarter of 2015. That brings the total market to a hefty $5.6 billion, and that's no small market. However, within this market there were some clear imperatives and some unexpected twists worth noting.

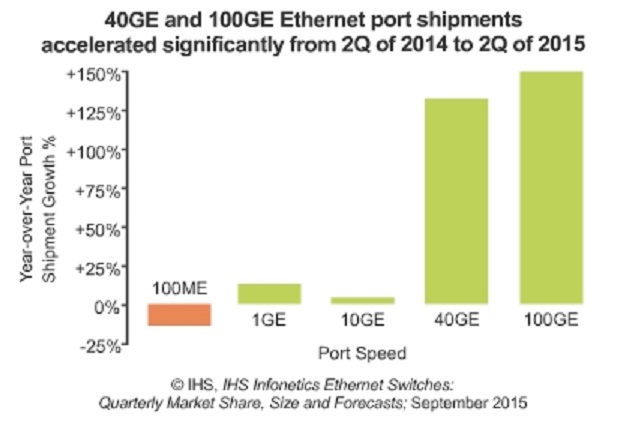

The biggest such twist was that not all components of the market were created equal, and thus some saw lesser gains, and others actually lost ground. For instance, IHS' research director for enterprise networks and video Matthias Machowinski, noted that the “white box switch solutions” market saw “muted demand” in recent days, but expects this sub-market to take off upon the arrival of 25 and 100GE solutions later this year. Indeed, 40GE port shipments saw serious gains, more than doubling the previous year's figures with a 132 percent growth in the second quarter of 2015. That growth meant a decline in growth for 10GE ports, though it was still positive. Meanwhile, 1GE ports also saw lower growth, but actually saw greater growth than the 10GE market. However, the 100ME market actually saw a decline, dark news amid all that growth.

For the second quarter of 2015, the North American market proved the major growth engine, picking up 14 percent extra, and Huawei also saw big growth in its offerings. Huawei actually managed to land the number three slot overall for the global Ethernet switch market. Cisco, meanwhile, is also making some gains, up one point against the same time last year.

Speed in the network will always be a plus, and will likely always be a driver of growth when it comes to network revenues. People want to be able to do more with the same amount of time, and so network responsiveness will be a big part of that. Throw in the increased demand thanks to more and more data centers coming online and the like, along with virtualization and other network uses, and the idea that the network needs to be faster just to keep up becomes a more rational idea than some may have thought at first.

With network switches getting faster, and “faster” in general becoming a valuable commodity in the network, the Ethernet switching market will likely continue to see growth. That growth may be lopsided, but even this lopsided nature will favor speed above just about anything else.

Edited by Dominick Sorrentino