Report Sees 25GE Ports as 9 Percent of Converged Data Center Network Adapter Market by 2019

As has been, and will be a constant refrain that will remain so that characterizes everything about data networking, the need for speed is insatiable. This includes WAN connectivity and speeds and feeds that connect all of the compute, storage and networking capabilities within data centers where demand is exploding. On top of this we are looking at the convergence of network adaptors as IT looks to transition to ever higher speeds and more next generation multipurpose data center network appliances for a host of reasons.

Confirmation of this need for speed and the changing networking landscape inside data centers came recently in the IHS Infonetics SAN and Converged Data Center Network Equipment. This is a quarterly which tracks:

- Chassis and fixed Fibre Channel switches

- Fibre Channel HBAs

- Converged data center switch ports-in-use for storage (iSCSI, FCoE, FC to FCoE)

- Converged data center network adapters (iSCSI, CNAs).

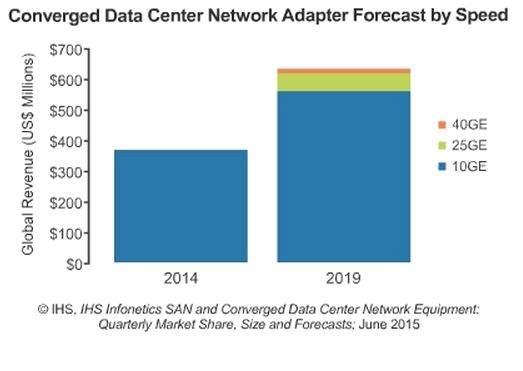

As the report highlights, the transmission of Ethernet frames at 25 Gigabits per second (25GE) is making its presence felt in the converged network adapter market. In fact, IHS Infonetics is projecting that an estimated 2,500 25GE ports will ship in the fourth quarter of 2015, growing to 9 percent of all adapter ports shipped worldwide in 2019.

“With its higher bandwidth, the 25/100GE architecture is attractive to large cloud service providers and enterprises looking to migrate from 10GE switching and server connectivity to 100GE switching and 25GE server connectivity in the data center,” said Cliff Grossner, Ph.D., research director for data center, cloud and SDN at IHS.

He added that: “QLogic continues to prepare for the launch of 25GE, demonstrating interoperability with HP and Dell switches after doing so with Broadcom.” More significantly in terms of watching a sea change in data center network equipment buying trends, Grossner noted that, “The Fibre Channel SAN market is seeing weaker demand for flash drives, negatively impacting revenue expectations for 2015,” Grossner said.

Additional findings of note include:

- Global Fibre Channel storage area network (SAN) revenue—including Fibre Channel switches and host bus adapters (HBAs)—is down 11 percent sequentially in 1Q15, and up 1 percent from 1Q14, to $595 million.

- Brocade continues to lead the FC SAN market, but faces operational issues with the IBM/Lenovo transition.

- Insights about Emulex is being acquired by Avago Technologies for ~$609 million

As the forecast shows, while the need for speed may be on data center operators’ minds, even by 2019, other than what is likely to be demand from the growing population of hyperscale data centers the 10GE market will still make up the dominant share. The kicker here may be just how fast the desire for a converged solution takes hold since the benefits of having higher speeds would be there for the taking.

Edited by Maurice Nagle